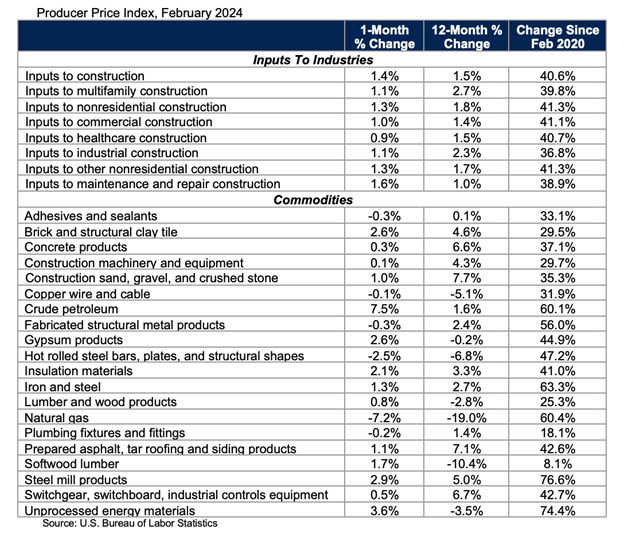

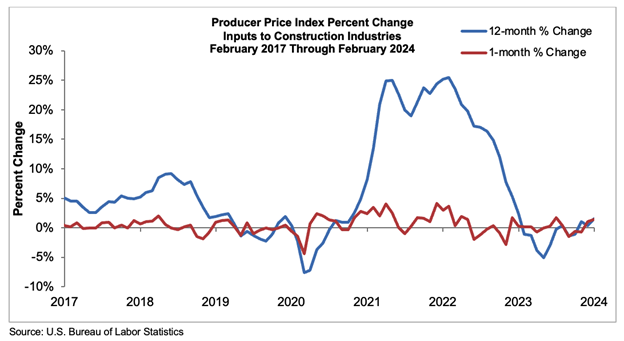

Construction input prices increased 1.4% in February compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data. Nonresidential construction input prices increased 1.3% for the month.

Overall construction input prices are 1.5% higher than a year ago, while nonresidential construction input prices are 1.8% higher. Prices increased in 2 of the 3 energy subcategories last month. Crude petroleum input prices were up 7.5%, while unprocessed energy materials were up 3.6%. Natural gas prices declined 7.2% in February.

“For the last several weeks, inflation data have been coming in hotter than anticipated,” said ABC Chief Economist Anirban Basu. “This was also true for the February construction input price data, which indicated that upward price pressures are reemerging after a period of calm. Monthly inflation was apparent in several categories, including brick/tile, gypsum and steel mill products. With supply chains around the world rattled by military conflicts and other phenomena and workers’ wages far higher than they once were, there is reason to believe that inflation will remain stubbornly high for months to come.

“For contractors, today’s release is bad news for at least two reasons,” said Basu. “First, higher input prices implicate lower demand for construction services all else equal. With project financing costs already elevated, project owners are less likely to move forward with construction work given already high and rising input costs.

“Second, recent inflation data render it more likely that interest rates will remain higher for longer. For weeks, the conventional wisdom has been that the Federal Reserve was poised to reduce interest rates. Today’s inflation data, along with other releases, suggest that hopes for rapidly declining rates were somewhat premature.”