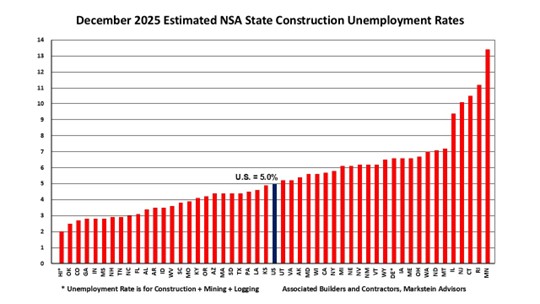

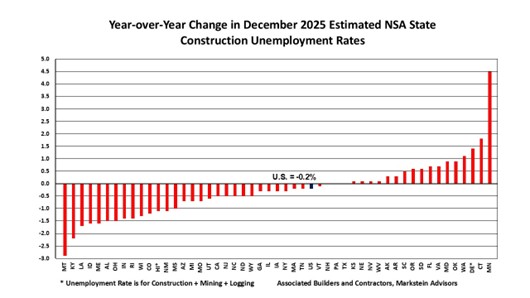

The national December 2025 not seasonally adjusted construction unemployment rate was 5.0%, a 0.2% decrease from December 2024, according to a state-by-state analysis of U.S. Bureau of Labor Statistics data conducted by Associated Builders and Contractors. The analysis found that 60% of states (30) had lower estimated construction unemployment rates over the same period, 17 had higher rates and three states (New Hampshire, Pennsylvania and Texas) had the same rate. All but five states had construction unemployment rates below 8%.

Note that, as a result of the 2025 government shutdown, no October labor data were collected, so those data are missing/not available.

National NSA payroll construction employment was 12,000 higher than December 2024, its smallest year-over-year increase since March 2021 when it fell during the pandemic. Seasonally adjusted payroll construction employment was 8.3 million, or 9.1% above its pre-pandemic peak of 7.6 million.

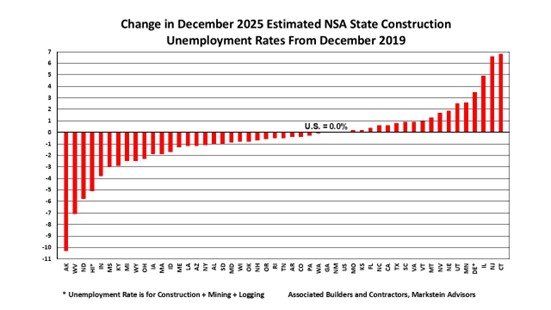

Estimated state construction unemployment rates were lower than their pre-pandemic level in 60% of states. As of December 2025, 30 states had lower construction unemployment rates compared to December 2019, while 18 states had higher rates and two states (Georgia and New Mexico) had the same rate.

“The construction industry continues to contend with weaker demand from the headwinds of tariffs and supply disruptions pushing building materials prices up, increasing insurance costs and an uptick in immigration enforcement contributing to a shortage of skilled construction workers, which has added to pressure to raise wages and salaries,” said Bernard Markstein, president and chief economist of Markstein Advisors, who conducted the analysis for ABC. “On the positive side, a somewhat easier policy stance by the Federal Reserve has resulted in lower interest rates. Further declines in interest rates are likely this year. Adoption of software and equipment powered by artificial intelligence may help some companies to control costs and reap greater efficiency from their existing workforce.”

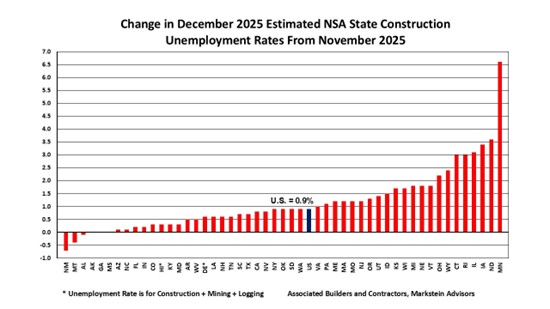

Recent Month-to-Month Fluctuations

In December, the national NSA construction unemployment rate climbed 0.9% from November. Three states (Alabama, Montana and New Mexico) had lower rates, 44 posted higher rates and three states (Alaska, Georgia and Mississippi) had the same estimated construction unemployment rates as in November.

The Top States

The six states with the lowest estimated NSA construction unemployment rates for December were:

- Hawaii, 2.0%

- Oklahoma, 2.5%

- Colorado, 2.7%

- Georgia, Indiana and Mississippi (tie), 2.8%

Both Hawaii and Indiana had their lowest December NSA estimated construction unemployment rate on record. Note that Hawaii’s unemployment rate is for construction plus mining and logging. Colorado posted its second-lowest December rate on record behind the 1.8% rate the state achieved in December 2021. Georgia and Oklahoma each had their third-lowest December construction unemployment rate on record.

The Bottom States

The five states with the highest September estimated NSA construction unemployment rates were:

- Illinois, 9.4%

- New Jersey, 10.1%

- Connecticut, 10.5%

- Rhode Island, 11.2%

- Minnesota, 13.4%

Rhode Island recorded its lowest December rate since its December 2022 rate of 8.9%.

Click here to view graphs of U.S. and state overall unemployment rates (Tab 1) and construction unemployment rates (Tab 2) showing the impact of the pandemic, including a graphing tool that creates a chart for multiple states. To better understand the basis for calculating unemployment rates and what they measure, check out the Background on State Construction Unemployment Rates.